There are numerous justifications for opening a dollar bank account. Perhaps you frequently get money transfers from family members who live overseas, you frequently travel, you enjoy shopping in the US, or you work with clients and suppliers from other countries.

The best course of action is to open a dollar account if any of these situations apply to you. If not, you can be forced to pay outrageous fees and incur losses due to fluctuating currency rates.

Making the best pick, however, can quickly become daunting given the vast number of dollar accounts that are available in the Philippines.

You want to open a dollar account but are unsure which one to choose. Not to worry. The greatest dollar accounts in the Philippines are listed for you in this guide.

What is a Dollar Account?

A dollar account, also known as a domiciliary account, is a form of current account that enables users to keep foreign currencies, including but not restricted to dollars, euros, and other foreign currencies.

This account’s principal objective is to make it easier for you to do international transactions. Using this account also gives you the option of sending or receiving money abroad.

Contrary to other bank accounts, most consumers use dollar accounts to conduct transactions rather than to hold money and collect interest.

Advantages of a Dollar Account

The main advantages of opening a dollar account in the Philippines are listed below.

Big savings

Everyone wants to avoid paying expensive fees and save money. You can purchase and sell foreign currencies right immediately or use your foreign currency without needing to convert it to another one if you have a dollar account.

You can reduce transaction expenses in this way.

Prepare foreign currency

Having a dollar account will make it possible for you to have money available, whether you enjoy traveling or shopping. By doing this, you may avoid worrying about fluctuating foreign exchange prices, particularly when the exchange rate is low.

Improved convenience

You can skip a step when it comes to using any foreign currency because you don’t need to exchange. Your money will continue to earn interest for you whether you utilize it straight away or not.

Your financial security is increased

Your portfolio can be diversified by using foreign currencies like the US dollar. You can protect your money against loss if the value of the Philippine peso rises or falls.

A reasonable interest rate

Dollar accounts pay interest, just like conventional savings accounts do, but you might have to keep a certain amount of money in the bank for the income to accrue.

In light of this, you may sit back and watch your money rise

Remember that tiers of interest rates apply to most dollar accounts, and it is typical for these accounts to have a lower interest rate than peso accounts.

Safety

The PDIC insures individual dollar deposits in the Philippines. You may be sure that you won’t lose any foreign currency worth up to 500,000 Philippine Pesos.

Is a dollar account necessary?

Not everyone requires a bank account in dollars. However, companies who frequently conduct business in other currencies should open one, particularly those involved in exporting, importing, and similar activities.

Individuals require a dollar account if they frequently receive remittances from abroad or if they frequently do business with overseas clients.

If you enjoy traveling or shopping abroad, it’s also a wonderful idea to open a dollar account. You can have foreign currency available for use in this manner.

Is it wise to invest in a dollar account?

Depending on your situation, this. Having a dollar account is generally a good idea if you want to diversify your portfolio, especially if you use it to keep US dollars, which are a currency that can be easily utilized all over the world.

Prioritize your peso assets first, though, before opening a bank account in dollars. Analyze your risk tolerance first, just like with other investments.

Would you be able to take the loss, for instance, if the peso’s value rose?

What amount is required to start a dollar account?

Dollar accounts have stricter requirements, in contrast to most peso accounts, which do not require an initial deposit of any kind.

The majority of banks need an initial deposit of between $200 and $500. You must also keep an average daily balance between $500 and $1,000 in order to receive interest. We’ll talk more about this later.

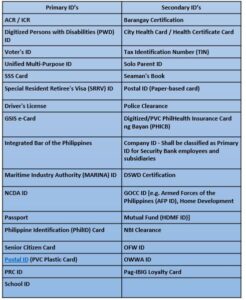

Valid ID’s Including Secondary ID’s

Top Philippine Banks That Provide Dollar Accounts

- Landbank

- BPI

- DBP

- Metrobank

- PNB

- Citibank

- Maybank

- HSBC

- China Bank

- Security Bank

- BDO

Conclusion

There are several reasons why the US dollar is more powerful than other national currencies around the world.

The US dollar is a great option to save instead of your local currency since there are more chances for your local currency to experience inflation than there are for the US dollar. This is not to say that the US dollar is not affected by inflation; nevertheless, the impact on your local currency is far greater than on the US dollar.

The US currency has a long history of serving as, among other nations, the global Federal Reserve. Using your home money to transact online is typically restricted to your nation. This implies that you will still need to convert your local money to dollars before most businesses and international organizations would take it.

The US dollar, on the other hand, has many opportunities for widespread, simply use.