A partnership is a type of commercial entity in which the owners are personally liable for the acts of the company. A partnership’s proprietors have put their own money and labor into the firm, and they participate in the earnings correspondingly.

Limited partners in the firm may also contribute capital but are not involved in day-to-day operations. A limited partner is only liable for the amount of money he or she put into the business; once those funds have been paid out, the limited partner is no longer liable for the partnership’s activities.

There must be a designated general partner who is an active manager of the business if there are limited partners; this individual has essentially the same liabilities as a sole proprietor.

The Benefits of a Partnership

The following are the main benefits of forming a partnership:

- Source of funds. A business with several partners has a considerably more diverse source of financing than a lone proprietorship.

- Specialization. If there are more than one general partner, a business can be handled by many people with different skill sets, which can improve overall performance. In general, this could indicate that the company has more competence.

- Tax filings are kept to a bare minimum. A partnership’s Form 1065 is not a difficult tax return to file.

- There will be no double taxes. There are no multiple taxes, as there might be in a corporation. Profits, on the other hand, go straight to the owners.

There will always be things that you excel at and others that you struggle with. Having a business partner can help you round out your talents and strike the right mix of strengths and weaknesses. It might also help to highlight your company’s advantages.

Find someone who is good at dealing with money, for example, if you aren’t very good at it. Find someone who can complement your leadership skills if you’re skilled at it. Look for someone who can help you achieve balance and compliment your current skill set.

When there is a sense of equilibrium, progress will be made anytime specific acts are taken.

Partnership’s Disadvantages

The following are some of the downsides of forming a partnership:

- Liability is limitless. As with a sole proprietorship, the general partners have unlimited personal liability for the partnership’s liabilities. This is a joint and several liability, which means creditors can go after a single general partner for all of the company’s debts.

- Taxes on self-employment. The self-employment tax applies to a partner’s share of ordinary income reported on a Schedule K-1. This is a 15.3% tax on all earnings made by a corporation that are not excluded from these taxes (social security and Medicare).

Due to significant changes in the remittance and payments market, businesses are considering one of two options: outsource remittances services or keep in-house remittances. Currently, most enterprise billing departments rely on labor-intensive, costly, and error-prone manual or partially automated processes.

Outsourcing remittance responsibilities, on the other hand, is a convenient alternative to time-consuming billing requirements. Professional transaction processors can provide automated remittance solutions that save time, money, and resources when it comes to business billing.

Reasons to Partner with Remittance Services Provider

Antiquated remittance methods are becoming outmoded as check usage drops and more clients switch to digital forms of payment. Not to add, without automated, efficient remittance systems in place, it’s becoming increasingly impossible for businesses to keep up with invoicing and payment demands.

By providing timely deposits, reporting, and automated updates to accounts receivables (AR) systems through secure transmission, outsourced remittance services remove the guesswork and time-consuming processes from billing and payment practices.

There are also other reasons to work with billing processors for remittance:

- Third-party processors automate high-dollar and low-dollar business-to-business or consumer-to-business transactions, increasing organizational efficiency. Staff may focus on more value-added projects with less time spent manually processing consumer payments.

- Avoiding Expensive Investments — With the rise of digital payments and bills, it’s becoming increasingly difficult to justify an in-house remittance processing team. Outsourcing services eliminate the need for large upfront investments and ongoing software maintenance costs.

- Keeping Legacy Solutions — The majority of outsourced remittance services do not necessitate overhauling existing systems. Look for a partner who uses safe electronic file transmission to send payment information to firm AR solutions.

- Enhancing Customer Support — Automated technologies used by third-party transaction processors enable same-day deposits and electronic delivery of payment data. Organizations become more nimble and client-centric when they can offer billing information to customers rapidly.

Bottomline

Not every business alliance succeeds. Finding the appropriate individual or company to get things done takes a lot of effort and time. When you find the proper person, you can expect a lot of positive changes, as well as some changes you don’t like. Everything that transpires after that is for the best as long as the person’s objectives and vision are apparent to you.

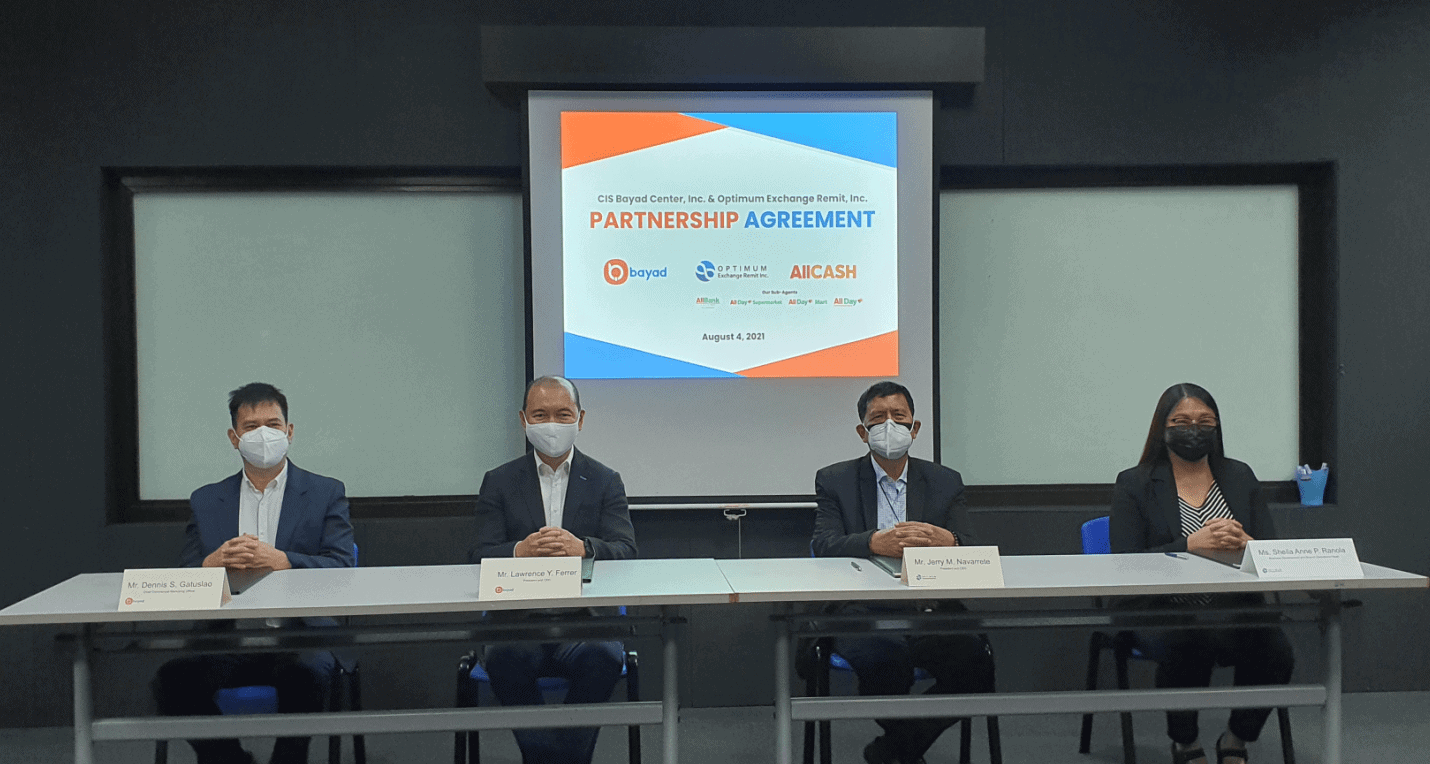

Bayad joins forces with Optimum Exchange Remittance, Inc., a foreign exchange and remittance firm that also operates AllCash, AllBank’s bill payment service, AllDay Supermarket, and AllDay Convenience Stores.

The agreement between Bayad and Optimum enhances AllCash’s bill payment capabilities, allowing users to pay their monthly bills while conducting activities like banking and grocery shopping.