After trading was halted due to Typhoon “Karding,” the peso started the day at P58.8 and moved between P58.7 and P58.999, with an average of P58.904.

Monday’s volume reached $1.0622 billion, up from $985 million the previous session. In spite of the US dollar’s ongoing strengthening versus other major world currencies, the local currency continued to decline against the US dollar for the sixth trading day by 49 centavos.

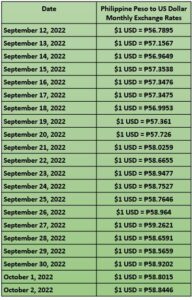

The preceding records on September 2, P56.77:$1, September 5, P56.999:$1, September 6, P57.00:$1, September 8, ₱57.18:$1, September 16, ₱57.34:$1, September 20, ₱57.48:$1, September 21, ₱58.0259:$1, September 22, ₱58.66:$1, and September 23, ₱58.94:$1 were followed by Monday’s figures.

In comparison to the P50.999:$1 at the end of 2021, the peso has lost P7.99, or 15.7%, since 2022 began. Michael Ricafort, chief economist of Rizal Commercial Banking Corp. (RCBC), blamed the US Federal Reserve’s aggressive rate increases to fight inflation for the weakening of the peso and the decline of most currencies.

“Ricafort informed one known media in a Viber message that the record low British pound (GBP/US dollar) and weaker euro also contributed to the strong US dollar story/narrative. The damage caused by Super Typhoon Karding, particularly to agriculture, he claimed, was also weighing on investor sentiment in the peso and on regional financial markets.

According to Ricafort, the super typhoon’s devastation could create “some pick-up” in the cost of food or other agricultural products as well as general inflation. The peso may encounter P59.00 to P59.25 levels as the next obstacle, according to the chief economist of the RCBC.

President Ferdinand “Bongbong” Marcos Jr. is “closely monitoring” the Philippine peso’s exchange rate with the US dollar, the Office of the Press Secretary reported on Tuesday. Press Secretary Rose Beatrix “Trixie” Cruz-Angeles stated during a press conference that the “Economic Team” was “closely following this” and that the President was in frequent contact with them.

Cruz-Angeles continued, “As you know, the inflation rate isn’t caused by any local variables; it’s mainly about the exchange rate. Due to the effects of the global economic slowdown, the International Monetary Fund reduced its 2022 growth prediction for the Philippines from 6.7 percent to 6.5 percent on Monday.

The economic team at Marcos revised its 6.5 percent growth forecast down from 7.5 percent. Cruz-Angeles declined requests for comment, preferring to rely on the nation’s economic experts instead.

Our economic managers predicted a greater growth rate, so they are in a lot better position to determine that determination in that forecast, the Palace official added. “We will have to see about it.

We will have to wait and see if that projection proves to be more correct than the local forecast, she continued, adding that “our fundamentals are robust, our economy is in good upswing, and we are currently having a good rate of growth.”