“The increase poses a potential to aggravate a downturn in the global economy and intensify central banks’ concerns about inflation”

The Federal Reserve’s commitment to combat domestic inflation by raising interest rates is wreaking havoc on other nations by driving up prices, expanding the size of debt payments, and boosting the possibility of a protracted recession.

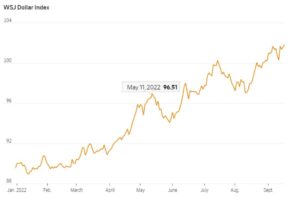

These interest rate increases are destabilizing the economies of both rich and poor countries by driving up the value of the dollar, which serves as the standard currency for most international trade and transactions. The dollar’s acceleration is contributing to stinging inflation in Britain and most of the rest of Europe.

The British pound hit a record low against the dollar on Monday as markets reacted negatively to the government’s proposed tax cut and spending plan. The yuan was set in China, which strictly manages its currency, at its lowest point in the previous two years while measures were taken to stem its collapse.

The ICE U.S. Dollar Index, which compares the value of the dollar to a basket of the country’s main trading partners, has increased by more than 14% this year, putting it on pace to have its greatest year since the index’s inception in 1985. In relation to the dollar, the euro, Japanese yen, and British pound have all reached multi-decade lows. Emerging-market currencies have taken a beating: the South African rand has lost 9.4%, the Hungarian forint has dropped 20%, and the Egyptian pound has dropped 18%.

The Fed’s rapid interest rate rises have prompted foreign investors to withdraw funds from other markets and place them in assets with higher yields in the United States, which has contributed to the dollar’s climb this year. Recent economic evidence points to persistently high U.S. inflation, supporting further Fed rate hikes and a stronger dollar.

The United States dollar is also rising due to the poor economic outlook for the rest of the world. Russia and Europe are engaged in an economic conflict. As a multi-decade property boom comes to an end, China is seeing its greatest slump in years.

The World Bank issued a warning on Thursday, predicting a global economic downturn and “a run of financial crises in emerging market and developing nations that would cause them permanent harm.”

The uncompromising message increases worry that financial pressures are increasing for emerging nations outside of well-known weak links like Sri Lanka and Pakistan, which have previously requested assistance from the International Monetary Fund. The IMF’s latest country to initiate negotiations is Serbia, which did so last week.

Since the 1990s, several nations have not had a cycle of significantly higher interest rates. The financing for the pandemic has added to the amount of debt that already exists, according to Mr. Rajan. According to him, emerging market stress would increase. It won’t be contained, I say.

The cost of repaying debts borrowed in US dollars by governments and businesses in emerging markets is increased by the dollar’s strength. Data from the Institute of International Finance, which covers 32 nations, shows that emerging-market governments have $83 billion in U.S. dollar debt due by the end of next year.

Rising currency values have made smaller countries’ problems worse by raising the cost of imports of essential goods like food and gasoline, which are priced in U.S. dollars. To assist fund imports and stable their currencies, many have used their reserves of dollars and other foreign currencies. Furthermore, despite the fact that commodity prices have fallen from recent highs, developing countries are still under considerable pressure.

According to Gabriel Sterne, head of emerging-markets research at Oxford Economics, “if you have additional dollar appreciation, that will be the straw that breaks the camel’s back.” Frontier markets are already on the verge of collapse; a strong dollar is the last thing they need.

The central banks of emerging markets have taken strong measures to stop the decline of their currencies and bonds. To combat rising inflation and safeguard the peso, which has fallen over 30% against the dollar this year, Argentina boosted interest rates on Thursday to 75%. Last month, Ghana similarly caught investors off guard by increasing rates to 22%, but the country’s currency is still losing value.